26+ Reverse payroll calculator

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. 2020 Federal income tax withholding calculation.

Reserve Ratio Formula Calculator Example With Excel Template

Computes federal and state tax withholding for.

. Biweekly pay 48 weeks. Customized Payroll Solutions to Suit Your Needs. Subtract 12900 for Married otherwise.

Reverse Tax Calculator 2022-2023. Here When it Matters Most. The weekly paycheck amount is given as.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Do Your Investments Align with Your Goals. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes.

The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week. Customized Payroll Solutions to Suit Your Needs. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business.

Ad Process Payroll Faster Easier With ADP Payroll. Hourly Paycheck Calculator. The overtime calculator uses the following formulae.

Find a Dedicated Financial Advisor Now. Below are your federal gross-up paycheck results. It uniquely allows you to specify any combination of inputs.

Discover ADP Payroll Benefits Insurance Time Talent HR More. Get Started With ADP Payroll. Here When it Matters Most.

Use this federal gross pay calculator to gross up wages based on net pay. You can use the calculator to compare your salaries between 2017 and 2022. Ad Process Payroll Faster Easier With ADP Payroll.

If your effective income tax rate was 25 then you would subtract 25 from each of these figures to estimate your biweekly paycheck. The maximum an employee will pay in 2022 is 911400. Free Unbiased Reviews Top Picks.

How to use a Payroll Online Deductions Calculator. In case someone works in a week a number of 40 regular hours. Do Your Investments Align with Your Goals.

Tax Management Automatically calculates files and pays federal state and local payroll taxes. PAPR Pay period 52 for Weekly 26 for Bi-Weekly or 12 for Monthly. Paycheck Results is your gross pay and specific.

Find a Dedicated Financial Advisor Now. For example if an employee receives 500 in take-home pay this calculator can be used to. This valuable tool has been updated for with latest figures and rules for working out taxes.

Salary commission or pension. Get Your Quote Today with SurePayroll. The FREE Online Payroll Calculator is a simple flexible and convenient tool for computing payroll taxes and printing pay stubs or paychecks.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Federal Gross-Up Calculator Results. The tool then asks you.

Plug in the amount of money youd like to take home each pay period and this calculator will tell you what your before-tax earnings need to be. Ad Heartland Makes Payroll Easy with Margin-Friendly Pricing for Your Business. This calculator helps you determine the gross paycheck needed to provide a required net amount.

Or Select a state. Ad Compare This Years Top 5 Free Payroll Software. Process payroll in 2 minutes or.

All Services Backed by Tax Guarantee. Finally calculate the Reverse Paycheck using the equation above. Get Started With ADP Payroll.

Some typical uses for the Date Calculators. First determine the weekly paycheck amount. Duration Between Two Dates Calculates number of days.

Payroll So Easy You Can Set It Up Run It Yourself. Easy Online Run payroll from work home or the office. Then enter your current payroll information and.

All other pay frequency inputs are assumed to. Ad Get Started Today with 2 Months Free. AS WP 52.

Example of a result. Multiply taxable gross wages by the number of pay periods per year to compute your annual wage. First enter the net paycheck you require.

Time and Date Duration Calculate duration with both date and. Usage of the Payroll Calculator. Discover ADP Payroll Benefits Insurance Time Talent HR More.

The results are broken up into three sections. Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. You first need to enter basic information about the type of payments you make.

The calculator is updated with the tax.

39 Accountant Resumes In Doc Free Premium Templates

How Can We Make A Calculator Using Javascript Quora

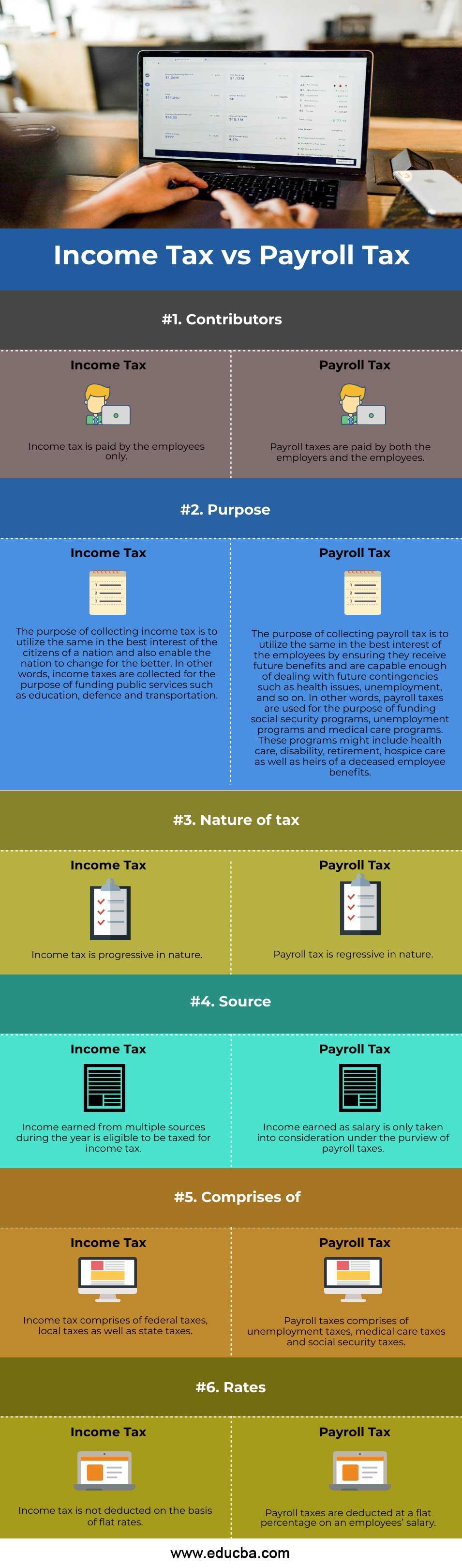

Income Tax Vs Payroll Tax Top 6 Differences To Learn With Infographics

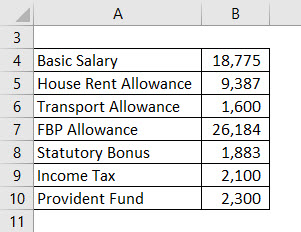

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Salary Formula Calculate Salary Calculator Excel Template

Heloc Mortgage Accelerator Spreadsheet Pay Off Mortgage Early Mortgage Loan Calculator Mortgage Loans

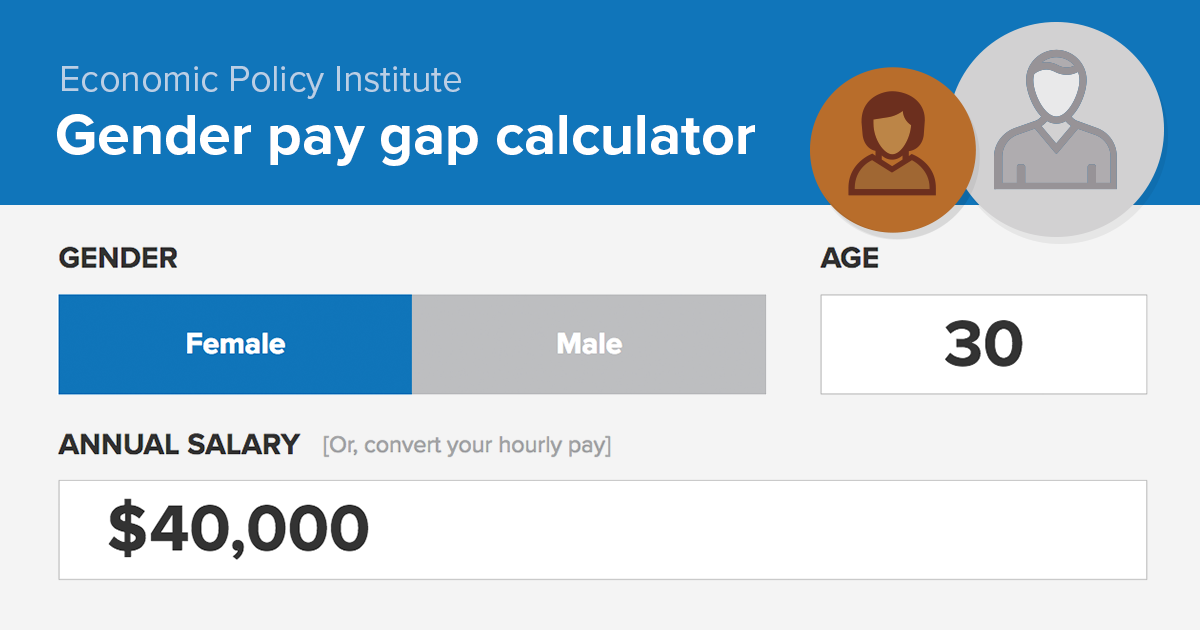

Another Reason Women Will March On Saturday For Better Wages And Greater Economic Security Economic Policy Institute

2

Salary Formula Calculate Salary Calculator Excel Template

For People Who Make Money Trading Options Can You Please Share Your Strategy To Help Or Should I Just Stop It All R Wallstreetbets

2

Sales Tax Calculator

Python Program To Calculate Gross Pay In 2022 Python Programming Python Calculator

Salary Formula Calculate Salary Calculator Excel Template

8hyckfp90m55lm

Income Tax Vs Payroll Tax Top 6 Differences To Learn With Infographics